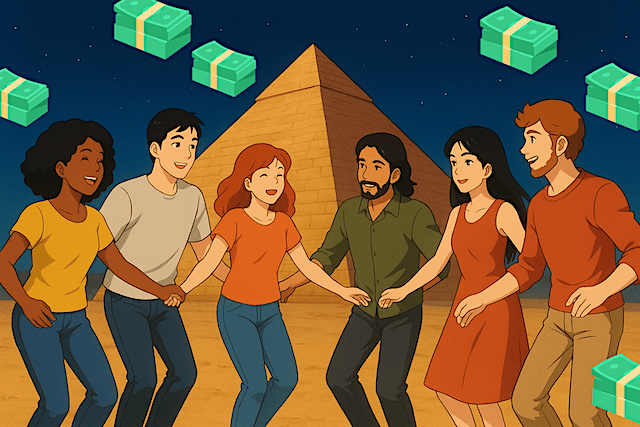

Pyramid and Ponzi schemes have been around for decades. The digital age of the 21st century has given them new life, making them easier to spread and cheaper to run. You’d think that after so many scandals and exposed cases, people would have learned to avoid these traps by now. Unfortunately, that’s not the case. The slick marketing of these schemes continues to have a huge impact – especially on younger generations who spend much of their lives online and are therefore more exposed to digital deception. Modern scammers have learned to operate in legal grey areas, often using trendy technologies like cryptocurrencies to lure and persuade victims.

Many faces, one goal: deception

These scams no longer show up only as exclusive “business clubs.” They now take on a wide range of disguises, tailored to modern trends:

Online marketing platforms

They claim to teach the secrets of e-commerce, dropshipping, or social media management. For a few hundred euros, they sell “exclusive training” and encourage you to recruit new “students” for a commission.

Fitness subscriptions and self-improvement programs

Sometimes the same model appears in the wellness world: a charismatic “coach” promotes their “revolutionary methods” while urging subscribers to become paid “ambassadors.”

“Entrepreneurial ecosystems”

These position themselves as private communities where members can learn to invest, start a business, or develop the right “mindset.” Access is usually by invitation and comes with a monthly fee.

In every case, the core principle is the same: real success depends on recruiting others into the system.

How modern scams are evolving

As regulations tighten, these schemes are becoming increasingly sophisticated:

- Legal loopholes – Instead of demanding an explicit “entry fee” (illegal in many countries), they sell “training courses” or “subscriptions.” Not all training offers are fraudulent, of course, but some use this setup to hide a pyramid structure: if you stop paying, you lose your team and future commissions—a disguised entry fee.

- Tech exploitation – Cryptocurrencies are a favorite tool. Some scammers create their own tokens, assign them arbitrary values, and promise absurd returns – sometimes 200% or 300%. The early participants profit, while later ones are left with losses.

- Diversified offerings – From training and investment programs to crypto and online services, scammers mix multiple products to obscure the real pyramid structure and make it harder to expose.

Warning signs to look out for

Be cautious if you notice any of these red flags:

- Unrealistic promises – Guaranteed returns over 10%, flashy “cashbacks,” or effortless “passive income.”

- Recruitment pressure – Your success depends on bringing in friends or family.

- Lack of transparency – Vague or confusing explanations of how profits are actually generated.

- Psychological manipulation – Urgency (“you must decide today”) or guilt (“you’re failing because you don’t have the right mindset”).

- Fake credentials – No authorization from financial regulators, or misuse of official logos and certifications.

How manipulation works

These schemes don’t just drain bank accounts—they also exploit personal relationships. To climb the ranks, members must recruit those closest to them, turning friendships and family ties into business opportunities.

This is why logical arguments often fail to convince victims. These organizations don’t just sell a product or service—they sell an identity, a sense of belonging, and the illusion of success. The emotional grip can be so strong that even when confronted with proof, some victims prefer denial to admitting they’ve been deceived.

How to protect yourself

There’s no foolproof method, but following these simple habits can greatly reduce your risk:

Verify information – Search for the company name and its founders alongside words like “scam” or “fraud.” Check official regulatory websites (such as the FCA, SEC, or BaFin) to see if the company is licensed—or flagged.

Be skeptical of “too good to be true” offers – There’s no such thing as guaranteed high returns or effortless income.

Take your time – Don’t rush into signing up. Step back, talk it over with people outside the scheme, and compare information from other sources.

Protect your circle – If success depends on recruiting your loved ones, that’s a major warning sign.

Ask for transparency – A legitimate business welcomes questions, provides clear documentation, and doesn’t rely on blind trust.

Seek diverse sources – Don’t rely solely on testimonials or social media posts, which can easily be manipulated or bought.

A constant battle

These scams are in constant evolution, adapting to new technologies and cultural trends. Today, they exploit the excitement around digital entrepreneurship and cryptocurrencies. Tomorrow, they’ll reinvent themselves around something else.

To delve deeper into this analysis, watch this documentary investigation that dissects from the inside the workings of one of these modern pyramid schemes, revealing their recruitment methods and the impact on victims.

Sources and references

Please switch to the French version of this article to read this paragraph.

Leave a Reply